Get Your Retirement Planning Guide Today

2026 Tax Planning Steps

In this document, Emerald Blue Advisors provides an informational guide outlining various tax planning steps for the upcoming 2026 tax year. The document highlights key areas to consider, such as maximizing deductions and savings incentives through IRAs, HSAs, and 529 plans. It also discusses tax-efficient investment strategies, Roth conversions, and the importance of revisiting estate plans due to potential changes in tax laws.

Tax Season Readiness Checklist

This guide provides a comprehensive tax season readiness checklist designed to help you prepare for the upcoming tax year. The resource outlines essential documents to gather, such as income statements and expense receipts, while offering advisors a strategic framework to proactively engage with clients and ensure a smooth, organized filing process.

Financial Wellness in 2026:

Building a Strong Financial Foundation

This guide is provided for building a strong financial foundation in 2026 through intentional habits and structured planning. It outlines actionable strategies for budgeting, emergency savings, retirement readiness, and goal setting to enhance long-term security and peace of mind.

5 Tax-Efficient Charitable Giving Strategies

This guide provides a comprehensive tax season readiness checklist designed to help you prepare for the upcoming tax year. The resource outlines essential documents to gather, such as income statements and expense receipts, while offering advisors a strategic framework to proactively engage with clients and ensure a smooth, organized filing process.

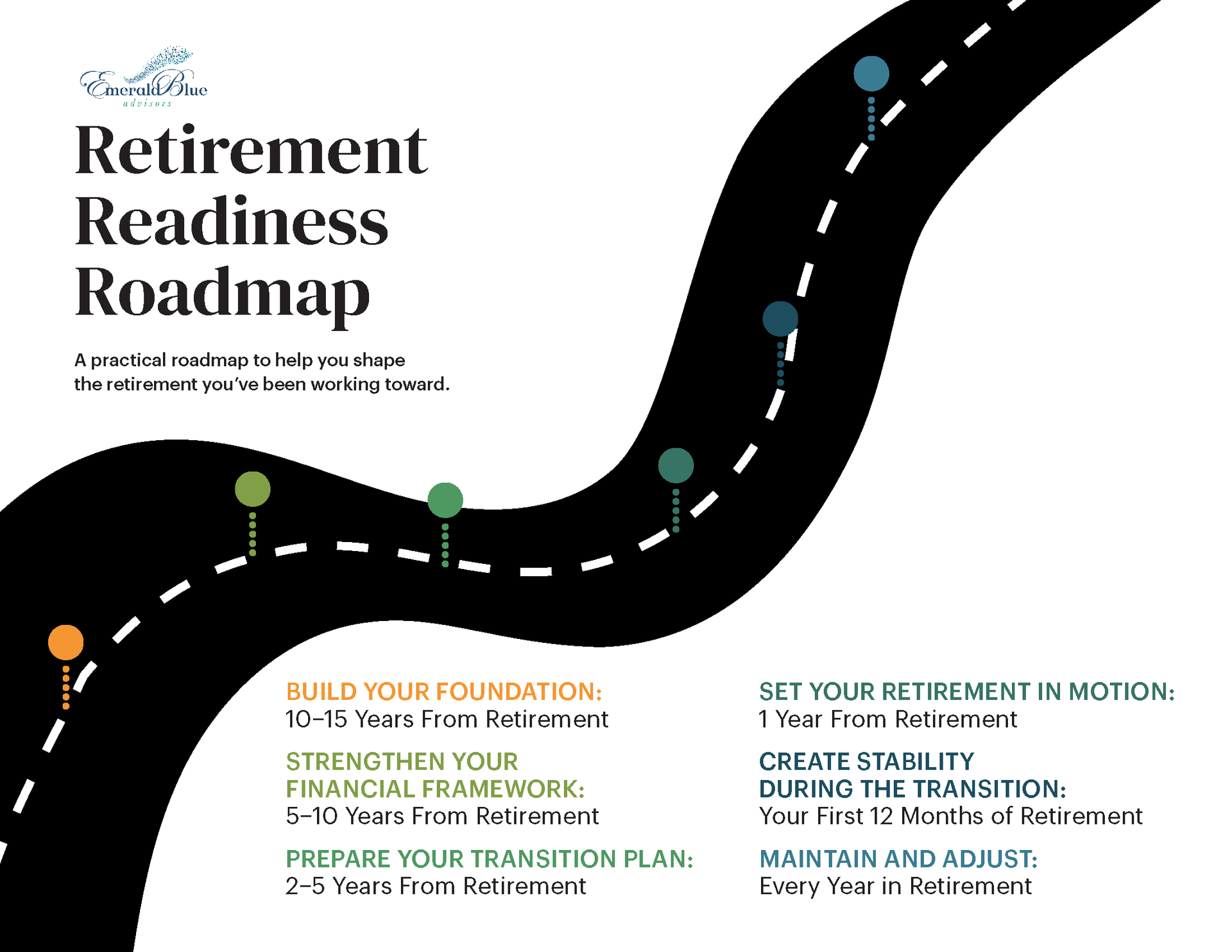

Retirement Readiness Roadmap

This guide provides a roadmap document designed to help individuals shape their retirement planning process. It outlines key steps and considerations across different time horizons, from 10-15 years before retirement to every year in retirement. Key topics include building a financial foundation, strengthening the financial framework, preparing a transition plan, setting retirement in motion, creating stability during the transition, and maintaining/adjusting the plan annually.